Last Updated August 13, 2020

EANE, in consultation with Employers Associations across the country, has prepared this decision tree to help employers determine compliance with the most recent COVID-19-related workplace legislation, including the Families First Coronavirus Response Act and CARES Act, as you confront making decisions affecting employment. This tool can also prove valuable in explaining certain workplace provisions to employees.

Overview of This Guide

| PATH ONE Keep Employees Working | PATH TWO Layoff or RIF |

|

|---|---|---|

| Requiring Employees to Work | Potential WARN Act Requirements | |

| Dealing With Symptoms & Exposure | Unemployment Provisions | |

| Credits For Paying Employees | CARES Act Unemployment Rules | |

| Reducing Employee Pay | Health Benefit Continuation | |

| Reducing Employee Work Hours | Deciding Who To Layoff | |

| Employee Leave & Sick Time |

Miscellaneous Provisions

- Direct Payments to Taxpayers

- Certain Penalty Waivers For Early Withdrawals From Retirement Accounts

- Pandemic Unemployment Insurance for Non-Employees

Disclaimer | We have designed this guide to be as accurate and authoritative as possible given the rapidly changing guidance from government officials, agencies, law firms and other experts. It is not intended nor designed to render legal advice and we strongly recommend contacting EANE or counsel before taking employment actions.

A PDF of this information is available here.

Path 1 | You Intend to Continue Employment

Requiring Certain Employees To Be At Work

- If your business is considered essential as defined by applicable State Executive Order, or other county or city stay-at-home orders if more stringent, then you generally can require employees to come to work. We recommend first exploring other possible work scenarios such as telework before requiring employees to come into work.

- Employees of essential businesses who refuse to come to work out of fear of contracting coronavirus would not be covered by the paid leave provisions of the Families First Coronavirus Response Act (discussed later).

- Absent a federal, state or local order to the contrary, employees refusing to come to work can be disciplined up to and including termination as a last resort after other alternatives have been explored. However, ensure your business is complying with all CDC recommendations and OSHA requirements and document your compliance before disciplining an employee who refuses to come to work due to safety concerns. In addition, their refusal may be protected under state laws or under the National Labor Relations Act. Employers are advised to implement telework, staggered schedules, and social distancing as much as possible.

- Employees of essential businesses who refuse to come to work out of fear of contracting coronavirus may be eligible for unemployment compensation, even though their employer is providing work.

- Since the CDC has deemed COVID-19 a pandemic, you also can require employees to take their temperatures at work or before leaving home, requiring any employees who register above 100.4° to stay home or go home.

Sending Someone Home Who Is Displaying Symptoms or Has Been Exposed

When to send someone home

- They are displaying COVID symptoms.

- They have been around someone with COVID symptoms.

- Their job isn’t essential, and they live in an area under a stay-at-home order.

- They are an asymptomatic employee who traveled to an area with widespread sustained transmission

When to return someone to work (Reflects most current CDC guidance as of 7/20/20)

Per the CDC, there are two options for determining when a person may end home isolation, using either (ONE) a time-since-illness-onset option and a time-since-recovery option, or (TWO) a test-based option.

ONE | Time-since-illness-onset and time-since-recovery strategy (non-test-based strategy)

Persons with COVID-19 who have symptoms and were directed to care for themselves at home may discontinue home isolation under the following conditions:

- At least 24 hours have passed since last fever without the use of fever-reducing medications and

- Improvement in symptoms (e.g., cough, sore throat, chills, nausea, fatigue, headache, muscle/body aches, runny nose/congestion, gastrointestinal (GI) issues, such as diarrhea or vomiting )

TWO | Test-based strategy (simplified from initial protocol)

Previous recommendations for a test-based strategy remain applicable. However, a test-based strategy is contingent on the availability of ample testing supplies and laboratory capacity as well as convenient access to testing. For jurisdictions that choose to use a test-based strategy, the recommended protocol has been simplified so that only one swab is needed at every sampling. Persons who have COVID-19 who have symptoms and were directed to care for themselves at home may discontinue home isolation under the following conditions:

- Resolution of fever without the use of fever-reducing medications; and

- Improvement in respiratory symptoms (e.g., cough, shortness of breath and other associated COVID-19 symptoms); and

- Negative results of an FDA Emergency Use Authorized molecular assay for COVID- 19 from at least two consecutive specimens collected ≥24 hours apart (total of two negative specimens). See Interim Guidelines for Collecting, Handling, and Testing Clinical Specimens from Persons Under Investigation (PUIs) for 2019 Novel Coronavirus (2019-nCoV) for specimen collection guidance.

- Persons with laboratory-confirmed COVID-19 who have not had any symptoms may discontinue isolation when at least 10 days have passed since the date of their first positive COVID-19 diagnostic test and have had no subsequent illness provided they remain asymptomatic. These persons should continue to limit contact (stay 6 feet away from others) and limit potential of dispersal of respiratory secretions by wearing a covering for their nose and mouth whenever they are in settings where other persons are present. In community settings, this covering may be a barrier mask, such as a bandana, scarf, or cloth mask. The covering does not refer to a medical mask or respirator.

*Note that recommendations for discontinuing isolation in persons known to be infected with COVID-19 could, in some circumstances, appear to conflict with recommendations on when to discontinue quarantine for persons known to have been exposed to COVID-19. CDC recommends 14 days of quarantine after exposure based on the time it takes to develop illness if infected. Thus, it is possible that a person known to be infected could leave isolation earlier than a person who is quarantined because of the possibility they are infected.

The employer should meet with returning employees and remind them to practice good respiratory etiquette and hand hygiene, avoid close contact with individuals who appear to be sick, and stay home if they begin to feel sick, for the health and safety of those employees and their coworkers, as well as the continued operations of the employer.

While the CDC advises employers to not require doctor’s notes due to the impact on the healthcare system, employers may require RTW notes under EEOC guidance and the FMLA guidelines for serious health conditions, if applicable.

Highly recommend/require returning employees to wear a face mask.

Continuing to Pay Employees

Small Business “Paycheck Protection Loans”

The CARES Act for employers establishes new “paycheck protection” loans administered by the Small Business Administration (SBA) to help employers continue to cover payroll costs and other expenses during the COVID-19 crisis. The covered period for loans was initially February 15, 2020 through June 30, 2020 but was later extended to December 31, 2020 as the result of the Paycheck Protection Flexibility Act of 2020.

- These loans are available for businesses with 500 employees or less. Businesses in the hospitality industry are eligible for a loan if they employ not more than 500 employees “per physical location.”

- The SBA has eligibility guidelines to determine whether a business qualifies as “small,” however, these rules are waived for hospitality businesses.

- Lenders will determine eligibility for the loans based on whether the business was operational as of February 15, 2020, had employees on payroll, and paid wages and payroll taxes.

- The loans may be used for payroll costs, healthcare, rent, utilities, and other debts incurred by the business. Also due to the Paycheck Protection Flexibility Act of 2020,atleast60% (previously had been 75%) of the forgiven amount must have been used for payroll. Notably, the definition of “payroll” costs excludes leave payments made pursuant to the new Families First Coronavirus Response Act (FFCRA). Reimbursement for those leave payments is made through the tax credit process enacted as part of that legislation. These “paycheck protection” loans are available for other payroll expenses and other costs.

- The federal government will forgive the loans in an amount equal to the amount of qualifying costs spent during a twenty-four week period after the origination of the loan (previously had been an eight week period). The amount of the loan forgiveness will be reduced if the employer reduces its workforce during the twenty-four week period compared to prior periods or reduces the salary or wages paid to an employee by more than 25% during the 24-week period. This reduction will be avoided if the employer re-hires all employees laid off or increased their previously reduced wages, no later than December 31, 2020 (the previous deadline had been June 30, 2020).

Additional mid-sized business loans

While not eligible for paycheck protection loans, mid-size businesses – those with 500 to10,000 employees – are also eligible for direct loans under the Emergency Relief and Taxpayer protections portion of the CARES Act. To receive a loan, the business must certify that:

- It intends to restore at least 90% of its workforce that existed as of February 1, 2020, to include re-storing all compensation and benefits for those employees as of the same date.

- It will not outsource jobs or abrogate an existing collective bargaining agreement for the term of the five-year loan and for two years after repaying the loan.

- It will remain “neutral in any union organizing effort for the term of the loan.”

Employee Retention Tax Credit

Tax credit not available to employers that receive the small business “paycheck protection” loans.

Provides eligible employers with a refundable payroll tax credit for 50% of the wages paid by employers during the COVID-19 crisis and applies to wages paid between March 13, 2020 and the end of the year. This tax credit is available to employers whose:

- Operations were fully or partially suspended due to a COVID-19 related “shut-down order,” or

- Gross receipts declined by more than 50% when compared to the same quarter in the previous year.

The tax credit is provided for the first $10,000 of qualified wages paid to an eligible employee subject to certain restrictions for employers with more than 100 full-time employees.

Payroll Tax Holiday

The CARES Act also provides that employers may defer payment of their portion of Social Security taxes they would otherwise be obligated to pay. Any deferred payroll taxes would be required to be paid over the next two years – with half of the owed amount being required to be paid by December 31, 2021, and the remaining half by December 31, 2022.

UPDATE: President Trump has signed a Memorandum dated August 8th instituting a payroll tax holiday deferring Social Security and Medicare taxes on wages paid between September 1, 2020 and December 31, 2020 to individuals whose bi-weekly wages or compensation are $4,000 or less (pre-tax). The details on how the deferments would be paid (or even forgiven) have yet to be determined as the Secretary of the Treasury is now charged with issuing guidance and regulations on next steps as of press time.

Qualified Disaster Relief Payments

Generally, amounts provided by an employer to an employee are considered taxable compensation to the employee and a deductible business expense for the employer. However, when a federal “qualified disaster” has been declared, an employer may make “qualified disaster relief payments” (QDRPs) to employees, and the assistance may be excluded from employee income under IRS Code, Section 139 (while also being deductible to the employer). QDRPs can include reimbursements of certain reasonable and necessary expenses incurred as a result of a qualified disaster including for personal, family or living expenses.

QDRPs do not include payments for expenses that are already being reimbursed by insurance (or otherwise) and generally do not include income replacement such as lost wages (see section 139(b)). QDRPs also, by definition, do not include payments made to assist employees with hardships that are not a result of a qualified disaster.

Reducing Employee Rate of Pay

- May be prohibited if employees are covered by employment contracts or collective bargaining agreements.

- For non-exempt employees, pay can be reduced to minimum wage but not below.

- For exempt employees, pay can be reduced to $684/week but not below.

- Employees receiving pay cuts may be eligible for unemployment compensation depending on the amount of pay cut. Employees are advised to apply online and list COVID-19 as the reason for their loss of income.

Reducing Employee Hours (Furlough)

Wage and Hour Concerns

Non-Exempt Employees

- Employers are only required to pay non-exempt employees for hours actually worked. Employers may require use of PTO/Vacation when hours are reduced if their policy allows.

- While there is some uncertainty if the DOL would require it, employers may pay employees stipends for home office use during the crisis.

Exempt Employees

- Employers may require use of PTO/Vacation when hours are reduced if their policy allows.

- While EANE doesn’t advise docking an exempt employee’s pay, it can be done, depending on whether the absence was initiated by the employee or employer.

- If the absence is initiated by the employee (including for his or her own illness or that of someone for whom he or she is caring), the employer may dock the exempt employee for full-day absences only.

- If the absence is initiated by the employer (e.g., the employee must stay home for a mandatory quarantine period, even though he or she is asymptomatic and willing to come to work), the employer may dock the exempt employee only for full seven-day absences that coincide with the employer’s pay week.

Unemployment Considerations

Employees may be eligible for unemployment benefits. Eligibility and benefit amount are dependent on many factors, including the percentage of the wage cut.

Placing employees on emergency FMLA or paid sick leave

Notable exemptions to the Emergency FMLA or Paid Sick Leave benefits: health care workers(both), emergency responders (both), most federal employees (FMLA only), certain small businesses with fewer than 50 employees (FMLA, #5 sick pay). See DOL’s FAQ’s (items 52 through 59) at https://www.dol.gov/agencies/whd/pandemic/ffcra-questions.

Health benefits are to be continued while on either sick time or emergency FMLA.

Families First Coronavirus Response Act (FFCRA)

Effective April 1, 2020 – December 31, 2020

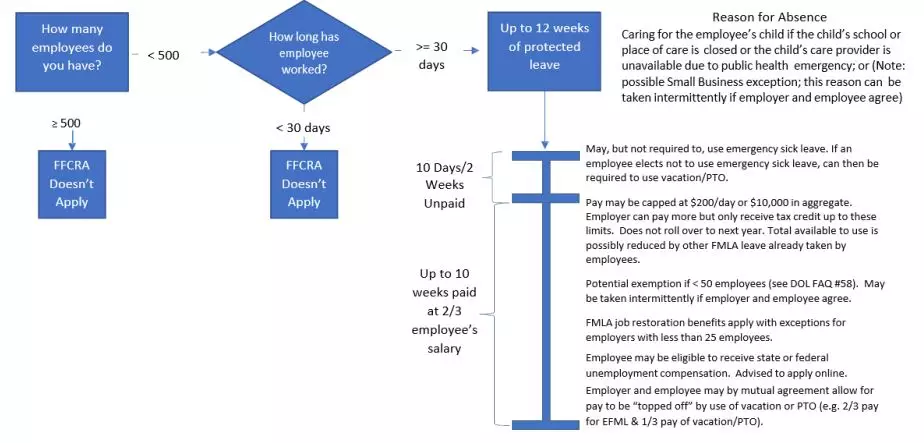

CHART 1 | EMERGENCY FMLA

The FFCRA provides up to 12 weeks of leave (10 weeks paid) for employees unable to work or telework due to having to care for a child less than 18 years old because of school or daycare being closed due to the COVID-19 public health emergency. Emergency FMLA is not available to employees where the business is shut down by general government order or lack of business or to employees who have been laid off. Use this flow chart to determine eligibility.

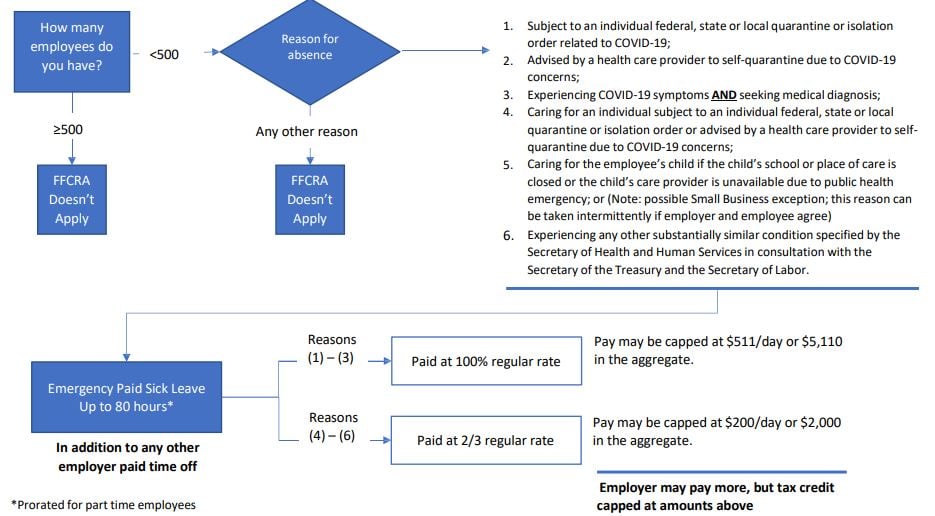

Chart 2 | EMERGENCY PAID SICK LEAVE

The FFCRA provides up to 80 hours of paid sick leave for various reasons related to COVID-19 (see below). Use this flow chart to determine eligibility. Emergency paid sick leave is not available to employees where the business is shut down by general government order or lack of business or to employees who have been laid off.

Path 2 | You Intend some sort of discontinuation of employment whether furlough or more permanent reduction in force/layoff.

Furlough or Layoff

Potential WARN Act notifications if employ 100 or more employees and experience a plant closing, mass layoff, or employment loss. Note, at this time it is still unclear if the WARN act will apply.

General WARN Act guidelines.

A layoff exceeding 6 months is an “employment loss” and requires 60-days’ notice or 60-days’ pay if the employment loss constitutes a “mass layoff” or “plant closing” (as defined by the federal WARN Act). Additionally, a reduction in hours of work of an individual employee of more than 50 percent during each month of any 6-month period could be an employment loss, triggering notice under the WARN Act, if the employment loss results in a mass layoff.

There are three general exceptions when notice is not required, but otherwise would be: (1) “Faltering Company” (which applies to plant closings only); (2) “Unforeseeable Business Circumstances” (which applies to plant closings and mass layoffs), and (3) “Natural Disaster” (which applies to plant closings and mass layoffs). Each exception is extremely fact dependent. Under the Unforeseeable Business Circumstances exception, the inquiry is whether an event or business circumstance precipitating the employment loss is “reasonably foreseeable” at the time notice should have been given. If the event/circumstance is caused by a sudden, dramatic, and unexpected action or condition outside the employer’s control, that may satisfy the “unforeseeable” definition. Notably, even if an employer qualifies under any of these exceptions, it still should give as much notice as is practicable, including a brief statement of its basis for reducing the notification period.

MA, CT, RI unemployment provisions related to COVID-19

- No waiting period

- Waiver of “able and available” hurdle but employees must stay in contact w/employer and be available for any work.

- No job search requirement. Claims can also be paid for employees choosing not to work.

- No charging to employer’s unemployment account if layoff due to COVID

- Employees apply online only

- Maximum weekly benefit of CT -$649, MA -$823, RI -$586

- Any worker who receives severance pay is considered to be attached to that employer’s payroll during that time and not eligible for UI benefits.

- Paid Time Off (Vacation and/or Sick Pay) will not be considered separation pay if the payment was issued as a result of the employer’s written policy established prior to your separation. Workers receiving Paid Time Off (Vacation and/or Sick Pay) under these conditions will not be disqualified from receiving benefits.

- Employers may supplement unemployment insurance with COBRA/group health premiums payments to employees without reducing the unemployment amount.

CARES Act Federal Unemployment Provisions

Unemployment Compensation for Individuals Eligible for Unemployment Compensation

Individuals who are otherwise eligible for unemployment benefits were eligible to receive $600/week in addition to their regular unemployment compensation until July 31st. Although the additional $600 per week is only available for the next four months, the maximum entitlement was expanded to 39 weeks rather than the 26 weeks typical of most states.

The $600 is payable by the State to the individual, to be reimbursed by the Federal Government.

Unemployment Compensation for Individuals who are Not Eligible for, or who have Exhausted, Unemployment Compensation Benefits

For weeks of unemployment, partial unemployment, or inability to work caused by COVID-19 between January 27 and December 31, the Act provides covered individuals with unemployment benefit assistance when they are not entitled to any other unemployment compensation or waiting period credit or have exhausted their state unemployment benefits. For this, the weekly benefit amount is generally the amount determined under state law plus an additional $600 until July 31st.

Covered individuals under this provision generally include those who provide self- certification the individual is otherwise able to work and available to work and is unemployed, partially unemployed, or unable to work for one of the following reasons:

- The individual is diagnosed with COVID-19 or experiencing COVID-19symptoms and seeking medical diagnosis;

- A member of the individual’s household was diagnosed with COVID-19;

- The individual is caring for a member of their family or household who was diagnosed with COVID-19;

- A child or person for which the individual has primary caregiving responsibility is unable to attend school or another facility that is closed as a direct result of the COVID-19 public health emergency and such school/facility is required for the individual to work;

- The individual is unable to reach the place of employment because of a quarantine imposed as a direct result of COVID-19 public health emergency;

- The individual is unable to reach the place of employment because a healthcare provider advised to self-quarantine due to COVID-19 related concerns;

- The individual was scheduled to commence employment and does not have a job or is unable to reach the job as a direct result of the COVID-19 public health emergency;

- The individual became the breadwinner or major support because the head of household died from COVID-19;

- The individual has to quit as a direct result of COVID-19;

- The individual’s place of employment is closed as a direct result of COVID-19 public health emergency; or

- The individual meets additional criteria established by the Secretary of Labor.

The Act excludes those who would otherwise be a covered individual if they have the ability to telework with pay or if they receive paid sick leave or other paid leave benefits.

- UPDATE: President Trump signed a Memorandum dated August 8th which further provides for individuals who are otherwise eligible for unemployment benefits to receive $400/week for benefits. The duration of time that the extended benefits will be available is in flux as the Memorandum stipulates that the additional benefit will be available for claims until either Department of Homeland Security’s Disaster Relief Fund (which is the fund used to support this benefit) draws down to a balance of $25 billion or for weeks of unemployment ending not later than December 27, 2020 – whichever comes first. Of this benefit, the federal government will absorb 75% of this cost with the states (should they elect to participate) absorbing the remaining 25% of the cost. In light of the uncertainty as to whether states will take part in this additional unemployment benefit offering (and with that option – take on the corresponding financial burden of doing so), it remains to be seen if an employer will encounter such additional benefit in their state and (if they do), whether such additional benefits would be charged to their unemployment account or would be charged to a state’s solvency program as those details are still to be determined.

Health benefits provisions

Reduction in Force. Any employee who loses eligibility for health coverage due to a termination in employment or reduction in hours should be offered coverage under the Consolidated Omnibus Budget Reconciliation Act (COBRA), generally for up to 18 months. This obligation generally applies to employers with 20 or more employees and applies to medical, dental, vision, and prescription drug coverage, as well as to health reimbursement arrangements, health flexible spending accounts, wellness plans, employee assistance programs, and on-site/off-site clinics that are governed by the Employee Retirement Income Security Act (ERISA).

Plant Closing. If an employer must close its business and ceases to provide a group health plan to any employees in the company or any affiliated businesses, then COBRA coverage may end earlier than the mandatory minimum 18-month period. In that case, employees may be left to pursue coverage options through private individual policies, a spouse’s employer, or public programs, such as the Affordable Care Act exchanges, Medicare, or Medicaid.

NOTE: For employees placed on furlough, the ability to remain on the health plan and not incur a COBRA event will be dependent upon whether or not you are an ALE under PPACA, what method you are using to determine eligibility under PPACA, your health insurance plan document, and health insurance contract. Check with your broker or carrier.

The employer may choose to pay the employee’s COBRA or group health premiums.

Determining Who To Layoff

Employees on regular FMLA, emergency FMLA, or emergency paid sick time may be laid off if they would have otherwise been laid off had they been continuously working. At the point of layoff, the paid leave mandated by the emergency FMLA and emergency paid sick time provisions would end.

Follow any established company policies, employment contracts, or collective bargaining agreements.

As with any downsizing, care should be taken to determine which employees will be affected to ensure only non-discriminatory factors are used to make the decision. At EANE, we say it’s best to select positions, departments, or grades versus selecting people. The safest course, legally, is to use objective criteria like seniority, productivity, or sales numbers. If you will consider subjective qualities like quality of work, willingness to learn new tasks, or communication skills, make sure everyone applies these criteria consistently. One question frequently asked is whether employers can use a lay off to release marginal employees. You may, however, we advise to do so only if performance issues are well documented in some form.

Make sure your layoff plan doesn’t discriminate (or appear to discriminate) on an illegal basis such as race, age, gender or any other protected characteristic. For example, if you lay off the workers on your list, will the company be getting rid of a disproportionate number of women or minority workers?

Make sure the workers who are left will be able to do the work that remains. Workers you don’t lay off will quickly begin searching for new jobs if they are asked to do twice as much work.

Miscellaneous Provisions

Direct Payments to Taxpayers

The CARES Act also provides financial assistance directly to certain U.S. residents. The Act generally provides a tax credit of $1,200 for individual taxpayers or $2,400 for joint taxpayers, plus $500 for each child of the taxpayer. These rebates are not taxable income for the recipients because they are a credit against tax liability.

These rebates are reduced based on the taxpayer’s adjusted gross income from either their2019 or 2018 tax return (or 2020 return if larger rebate). Specifically, the rebates are reduced by 5% per dollar of qualified income when the adjusted gross income exceeds $150,000 for joint taxpayers, $112,500 for a head of household, and $75,000 for all other taxpayers. The rebates would be completely phased out when the adjusted gross income exceeds $198,000 for joint taxpayers with no children, $146,500 for head-of-household taxpayers with one child, and $99,000 for single taxpayers.

These payments do not have to be repaid, nor do they reduce your future tax refund.

Certain penalty waivers for early withdrawals from retirement accounts

In addition to these rebates, individuals may be able to tap into their retirement accounts due to waiver of some early withdrawal penalties for COVID-19 related purposes. Specifically, a provision in the CARES Act waives the 10% early withdrawal penalty for distributions up to $100,000 from qualified retirement accounts for COVID-19 related purposes made on or after January 1, 2020. The income attributable to such distributions may be subject to tax over three years and the taxpayer may recontribute the funds within three years without regard to that year’s cap on contributions. The Act also provides flexibility for loans from certain retirement plans for COVID-19 relief.

The waiving of the 10 percent penalty applies retroactively to withdrawals beginning Jan. 1, 2020, for account holders if:

- They have received a diagnosis of COVID-19.

- A spouse or dependent has received a diagnosis of COVID-19.

- They experience, due to COVID-19, adverse financial consequences as a result of being quarantined, furloughed or laid off; having work hours reduced, or being unable to work due to lack of child care, or other factors as determined by the Treasury secretary.

Pandemic unemployment insurance for non-employees

Creates a UI system for business owners, self-employed, independent contractors, gig workers and those with a limited work history.

Applicants will have to provide self-certification that they are (1) partially or fully unemployed, OR (2) unable and unavailable to work because of one of the following circumstances:

- They have been diagnosed with COVID-19 or have symptoms of it and are seeking diagnosis;

- A member of their household has been diagnosed with COVID-19;

- They are providing care for someone diagnosed with COVID-19;

- They are providing care for a child or other household member who can’t attend school or work because it is closed due to COVID-19;

- They are quarantined or have been advised by a health care provider to self-quarantine;

- They were scheduled to start employment and do not have a job or cannot reach their place of employment as a result of a COVID-19 outbreak;

- They have become the breadwinner for a household because the head of household has died as a direct result of COVID-19;

- They had to quit their job as a direct result of COVID-19;

- Their place of employment is closed as a direct result of COVID-19; or

- They meet other criteria established by the Secretary of Labor.